Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

10/2/2024

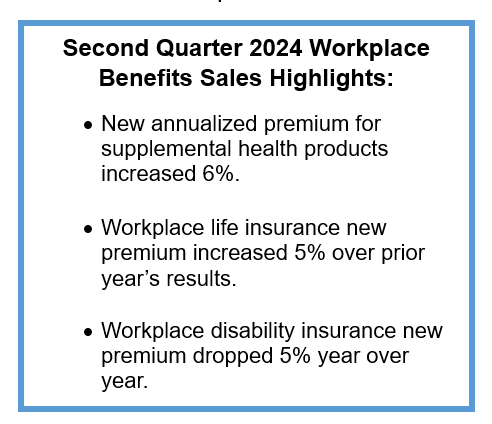

WINDSOR, Conn., Oct. 2, 2024 — According to LIMRA’s workplace benefits sales surveys, U.S. workplace supplemental health product sales ― accident, critical illness, cancer, hospital indemnity, and other supplemental health insurance products* ― totaled $550 million in the second quarter, a 6% increase over second quarter 2023. Year to date (YTD), these products totaled more than $2 billion in new sales, representing a 10% increase when compared to the same period last year.

A ccounting for 92% of supplemental health sales, the product lines of accident, critical illness and hospital indemnity insurance combined posted growth of 12% when compared to the first half of 2023.

ccounting for 92% of supplemental health sales, the product lines of accident, critical illness and hospital indemnity insurance combined posted growth of 12% when compared to the first half of 2023.

“Nearly 3 out of 4 carriers (74%) reported an increase in premium sales in the first half of 2024. Gains were double-digit or greater for 23 of the 29 companies (79%) reporting increases,” said Patrick Leary, corporate vice president and director of LIMRA’s workplace benefits research program.

Life Insurance

Workplace life insurance new premium totaled $656 million in the second quarter, increasing 4% from the prior year. New premium for term products rose 2%, while new premium for permanent products increased 9%. Permanent product sales represent approximately 15% of the workplace life insurance market.

Year-to-date, workplace life insurance new premium totaled $2.75 billion through the second quarter, a 5% year-over-year increase.

“The majority of carriers — nearly 7 in 10 — reported higher sales through the second quarter with 22 companies up by at least 9% over 2023 levels,” Leary notes.

Disability Insurance

Total workplace disability insurance new premium was $592 million in the second quarter, down 5% from prior year.

Total workplace disability insurance new premium was $2.4 billion in the first six months of 2024, down 4% year over year. Total short-term disability insurance new premium decreased 7% while long-term disability insurance new premium fell a modest 1% through the first six months of the year.

“The top 10 carriers, which account for 74% of total new disability insurance premium in the first half of 2024, posted a 6% decline, while the remaining carriers reported an increase of 3%,” Leary says.

LIMRA’s workplace benefits sales surveys for life insurance, disability insurance and supplemental health represent at least 90% of their respective annualized premium markets.

You can find the latest data table with U.S. workplace sales trends in LIMRA’s Fact Tank.

-end-

*“Other supplemental health products” represents products that do not fit the other categories, such as gap insurance, minimum essential coverage plans, limited benefit medical, and heart/stroke products.

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257