The Future of Workplace Life Insurance

The Future of Workplace Life Insurance

The ongoing pandemic has led Americans to place greater importance on insurance benefits, especially workplace life insurance. Employers have also begun to re-examine their workplace benefit strategies in order to address the changing needs of today’s workforce. The question the industry needs to answer is: Has the pandemic permanently altered employee and employer views on life insurance, or will their opinions and behaviors revert to pre-pandemic trends once things return to a new version of normal?

This article examines how the pandemic has affected recent trends in workplace life insurance coverage and implications for the future.

Employees have always valued the life insurance benefit they receive as part of their employee benefits compensation package. Nevertheless, the COVID-19 pandemic has heightened their awareness of and need for life insurance coverage. In fact, 47 percent of employees report that life insurance is more important to them now than prior to the pandemic.1 In addition, approximately 1 in 5 adults (21 percent) with workplace coverage purchased additional life insurance coverage due to COVID-19.

Given the increased emphasis employees place on life insurance today, it is not surprising that the coronavirus outbreak also had a notable impact on employer benefit strategies. Since the pandemic began, the majority of employers agree that employees place a greater emphasis on insurance benefits today than they did two years ago. This, in turn, has caused employers to take a closer look at the benefits they offer. Nearly 3 in 10 employers made changes to their benefits offering as a result of COVID-19. Life insurance was one of the top benefits added. Of employers that made a change to their insurance offerings due to COVID-19, 4 in 10 added a life benefit, while 1 in 4 eliminated that same benefit.

Pandemic-related trends notwithstanding, employment-based life insurance coverage has trended downward for the past 13 years. Since 2009, the percentage of private-sector employers offering a life insurance benefit has declined. Currently, less than half of these employers offer life insurance coverage to their employees. Furthermore, this decline corresponds to a decline in the importance employers place on life insurance. This trend may have contributed to the overall decline in the percentage of employers offering the benefit. Consequently, the percentage of workers with access to an employer-paid life benefit has also declined.

Will the increased importance employees are placing on life insurance — and the shifting employment landscape employers find themselves in today — be enough to reverse the trend from the past 13 years? Early indications say yes.

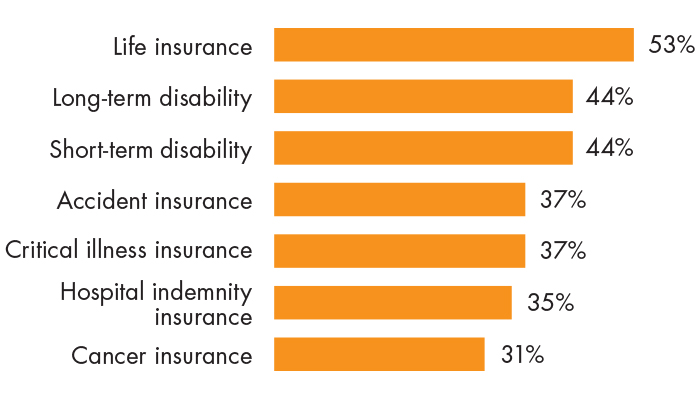

Employers and employees agree that employment-based life insurance is important to employees and their households. They also agree that workplace life insurance will be a valued and necessary offering for tomorrow’s workforce. Employers believe employees will be more interested in having life insurance offered at the workplace than other nonmedical insurance benefits in the future (Figure 1). While employers that currently offer this benefit are the most likely to express this sentiment, nearly 4 in 10 (37 percent) that do not currently offer a life insurance benefit believe their employees will be interested in coverage in the coming years. And — regardless of whether employees currently have life insurance available to them at the workplace — almost half (44 percent) are very or extremely interested in having their employer offer it in the future.

Figure 1

Employer Belief in Employee Interest in Benefits

Base: Employers currently offering at least one insurance benefit.

Note: Percentages represent employers that believe their employees will be extremely or very interested in the insurance benefits five years from now. Source: Harnessing Growth in Workforce Benefits series, LIMRA and EY, 2021.

While overall employer and employee opinions are encouraging, they may not be enough to guarantee future growth. Impediments such as the economy and an employee engagement gap are two issues that could curtail growth.

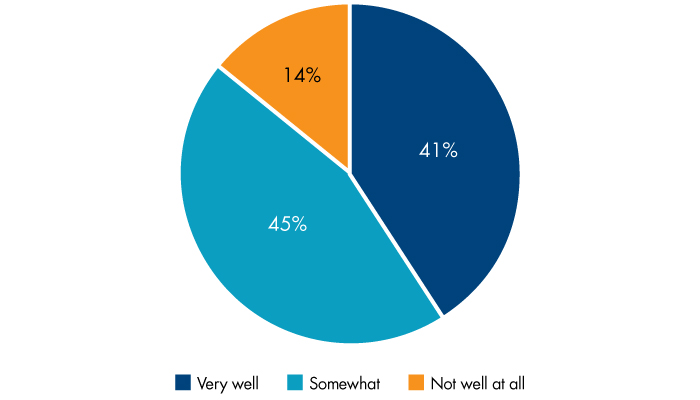

Figure 2

How Well Do Employers Communicate Their Life Insurance Benefit to Employees?

Base: Employed adults who have life insurance benefits available at work.

Source: Meeting the Life Insurance Need Through Workplace Benefits, LIMRA, 2021.

While employers can do little about the economy, they can work on closing the gap when it comes to employee awareness and understanding of benefits. While this gap has not widened recently, it has not closed either, despite the time, money, and effort employers spend on benefits communication. What is readily apparent from the employees’ perspective is that the current life insurance benefit communication materials provided to them are insufficient to meet the needs of a diverse workforce.

In truth, despite the increased importance employers are placing on life insurance benefits today, too many employees remain unaware of the benefit. Four in 10 employees could not definitively say if their employer offers a life insurance benefit. The youngest workers and those employed in smaller firms express the most uncertainty about the availability of life insurance coverage.2

Even for those employees enrolled in a workplace life insurance benefit, only 59 percent feel they have a good understanding of their benefit.3 Unfortunately, prior LIMRA research shows that employees actually lack a good understanding of the benefits and tend to overrate their level of knowledge.

This engagement gap exists in part because employers tend to overrate the success of their benefits communication approaches and believe they work well. Employee views are less favorable, however (Figure 2). In fact, employees only give their employers fair marks on how well they communicate their life insurance benefit to their workforce. This perception gap means that many of the benefit communication approaches employers use actually impede employee understanding of and awareness of benefits. These communication oversights, in turn, have consequences for employees when it comes to enrolling in the benefit and identifying the correct amount of coverage to have. While the underpinnings of the engagement gap are multifaceted, closing it is one way to ensure the future growth of this market.

Both employers and employees predict the value placed on life insurance with grow in the coming years. Time will tell if this increased interest in workplace life insurance is maintainable.

|

What prevents employees from better understanding their benefits?

SUGGESTIONS FOR IMPROVEMENT Employees suggest that employers provide:4

|

1 Consumer Sentiment Survey, unpublished data, LIMRA, 2021.

2 Consumer Sentiment Survey, unpublished data, LIMRA, 2021.

3 Ibid.

4 Consumer Sentiment Survey, unpublished data, LIMRA, 2021.