Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

11/21/2024

As the country comes out of the COVID-19 pandemic, new research by LIMRA and Boston Consulting Group (BCG) finds growth is the top priority for C-Suite life insurance executives. In light of relatively slow growth in the U.S. retail life insurance market over the past few decades and more than 100 million Americans living with a life insurance coverage gap, improving distribution productivity is widely recognized as a significant driver of market growth and fulfilling the mission of the industry.

In a recent LIMRA LinkedIn Live event, Bryan Hodgens, senior vice president and head of LIMRA research, and David Cockerill, managing director and partner, BCG, discussed how life insurers are measuring distribution productivity and the investments being made to advance its growth.

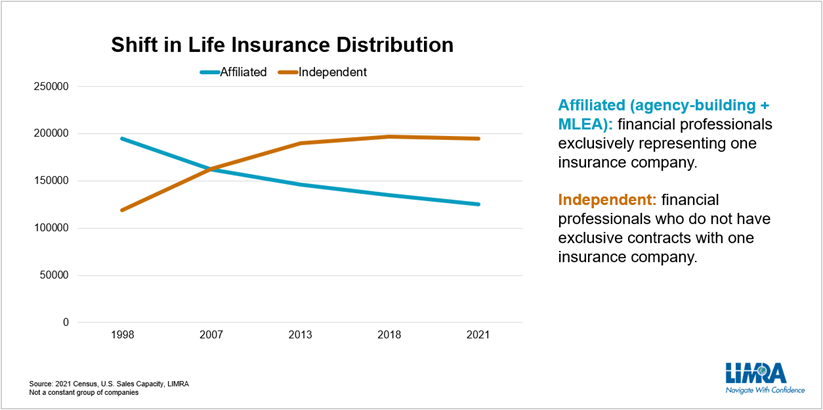

Cockerill began by outlining the two significant dynamics that are occurring in distribution. First, the overall number of financial professionals selling life insurance has not kept up with the population growth. While the US population has grown 50% over the past few decades, distribution has remained stagnant. In addition, there has been a significant shift in distribution, altering the power dynamic for carriers. According to LIMRA data, independent distribution has grown and overtaken the dominance once held by career/affiliated agents.

“It’s just math, we have fewer financial professionals servicing a larger population,” noted Cockerill. “One of the ways the industry can help is by better leveraging technology to make it easier to place business, allowing today’s financial professionals to become more productive and ultimately serve more customers.”

Top Strategies Carriers Are Implementing to Boost Distribution Productivity

The new study, Executive Insights Into Life Insurance Productivity 2024, finds carriers are taking a systemic approach to improving productivity. Hodgens described the efforts to establish key performance indicators (or KPIs) that align with the individual company goals.

“The most common KPIs focus on sales metrics — total premium and policy count — but companies often track other metrics, such as retention rate, placement rate, cross-sell rate, or customer satisfaction, to identify top performers and advance a company’s strategic goals,” said Hodgens.

The study reveals that when companies measure productivity, they can identify top-performing financial professionals and the behaviors that help elevate their productivity.

“One of the interesting things we learned was financial professionals in the top quartile in terms of productivity were about twice as productive than the median,” Hodgens continued. “If companies can figure out what works for the top quartile and get our median performers to move even a little bit, the industry will reach more consumers and get them the life insurance protection they need.”

The study recommends carriers implement a program of consistent monitoring, evaluation and fine-tuning to elevate ordinary performers to extraordinary.

Life Insurers Top Investment Priorities

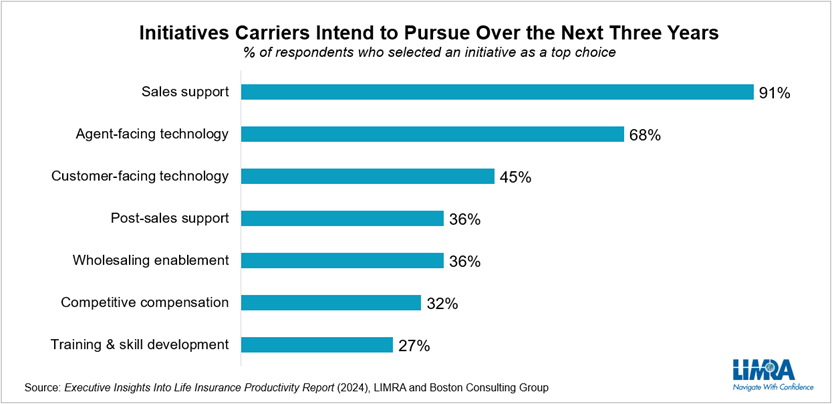

Overwhelmingly, C-suite executives said their company’s top priority was to invest in sales support initiatives. Greater investment in agent-facing and customer-facing technology rounded out the top three priorities mentioned by respondents.

“While these three items tend to overlap in terms of the sales support initiatives, the biggest challenge for companies is how to find the right balance of leveraging traditional marketing and sales support tools with things like analytics, artificial intelligence and other leading technologies to provide financial professionals with quality leads of potential clients who are ready to evaluate how life insurance (or other products) can fit their needs,” Cockerill said.

LIMRA research consistently shows that most consumers are interested in speaking with an expert when buying life insurance. The efforts to make the process easier for both financial professionals and consumers will advance the industry’s goal of helping more people protect their family’s future financial security with life insurance.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257