Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

11/2/2022

By: Todd Giesing, Assistant Vice President and Director of LIMRA Annuity Research

Today the Federal Reserve raised interest rates by 75 basis points, continuing its efforts to fight inflation. As a result, LIMRA anticipates a boost in annuity sales, as continued worries about equity market volatility and a possible recession have investors seeking safety.

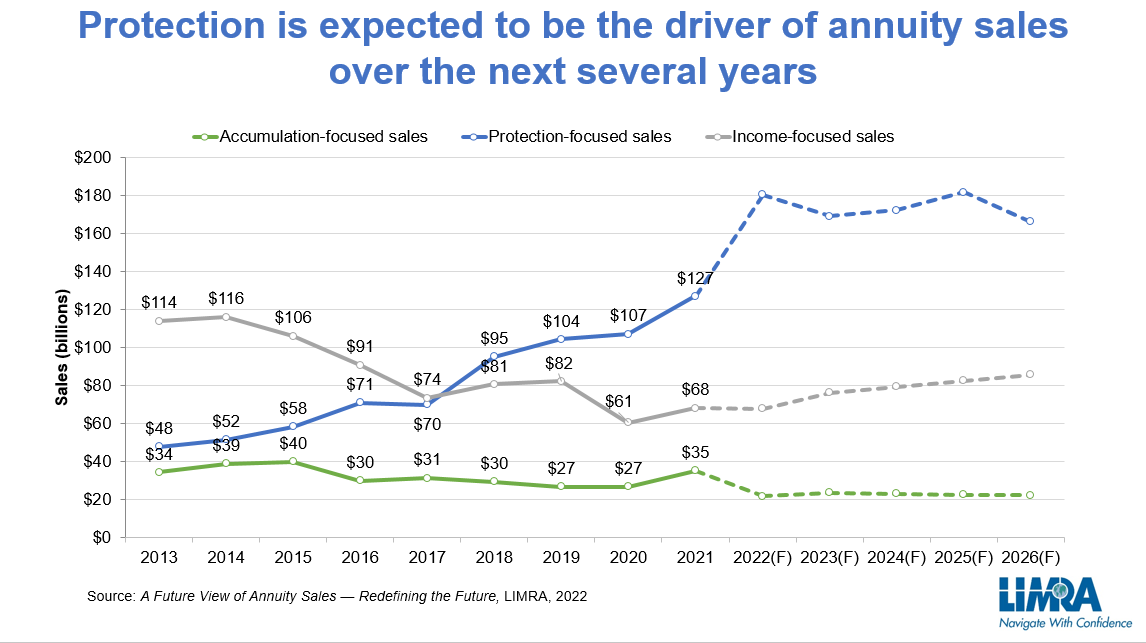

LIMRA research shows most Americans are buying annuities near or at traditional retirement ages to protect their investable assets from market volatility and/or to create a guaranteed income stream in retirement. With protection being the key driver of sales, rising interest rates will continue to make annuities an attractive solution as Americans navigate challenging economic conditions.

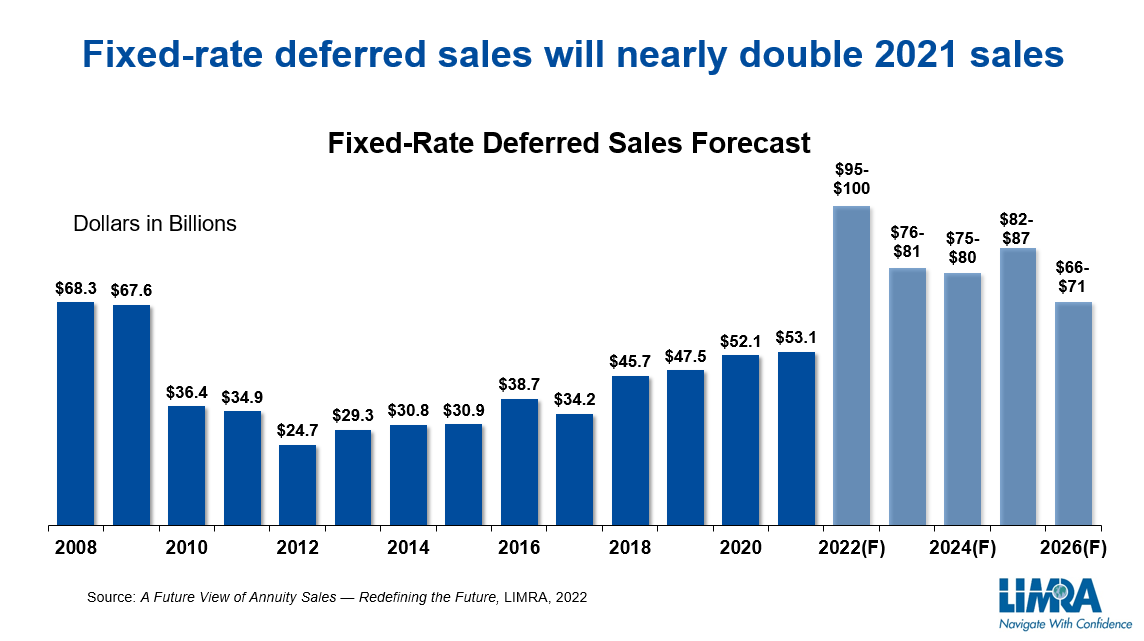

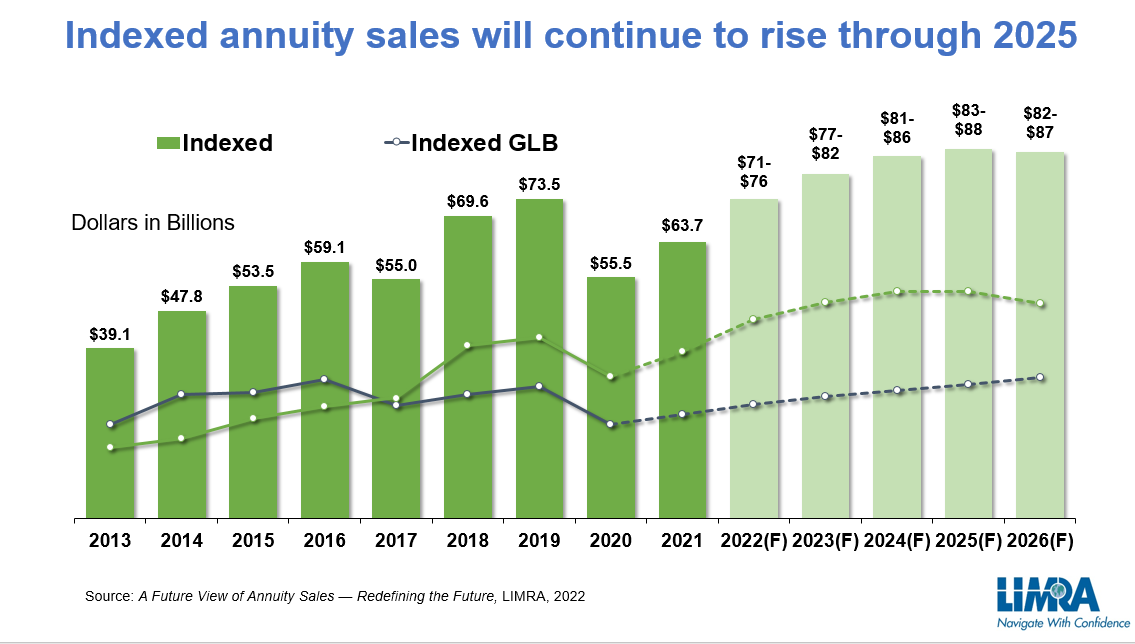

Yet the current interest rate environment does introduce greater competition to the fixed-rate deferred (FRD) annuity market. With short-term interest rates rising faster than longer-term rates, competitive alternatives, such as bank CDs, brokerage CDs, and other options that offer more liquidity, may become more attractive for individuals looking for safety. Today, the average crediting rates for 3-year FRD products have been significantly higher than the average rate of a 3-year CD. As interest rates rise, CD rates will likely improve, closing the gap. Still, increased interest rates will boost sales of other fixed annuity products (income annuities, fixed indexed annuities).

LIMRA Annuity Sales Forecast

Given the current and expected economic conditions, LIMRA is forecasting sales of FRD and fixed indexed annuities (FIA) to reach record levels in 2022, and FIA sales to continue to improve through 2025.

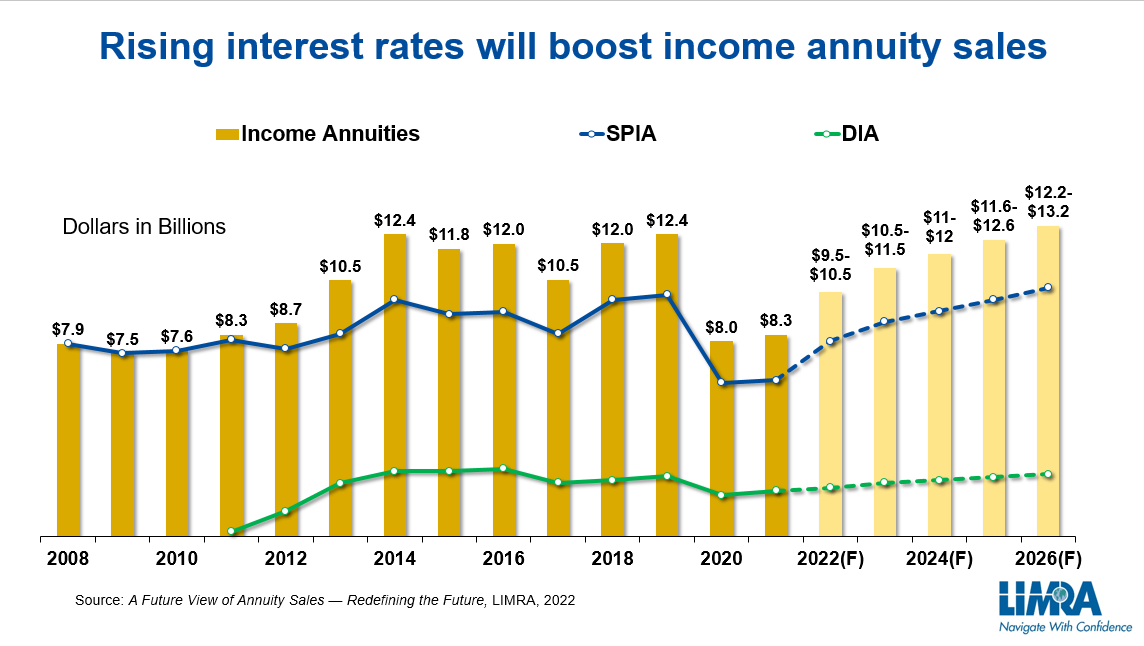

In addition, rising interest rates will help to increase the value in annuity products that provide the unique value of guaranteed income. This will boost sales of products, like immediate and deferred income annuities, which have suffered under a decade of ultra-low interest rates. Given the Federal Reserve signaling its intention to continue lifting rates, LIMRA expects the sales growth in these products to be delayed as investors wait in anticipation of higher rates in the near future.

As an insurance product, annuities offer the unique ability to protect principal, garner investment growth, and/or create guaranteed income, which is extremely attractive to Americans living in an economic environment not seen in more than 30 years. While conditions may change, LIMRA expects annuities will continue to be a tool to help individuals as they prepare for retirement.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834